|

View: 4710|Reply: 34

|

[Dunia]

Harga minyak bakal menjunam ke paras 20USD.. Ekonomi fasa deflasi?

[Copy link]

|

|

|

Oil could plunge to $20 and this might be ‘the end of OPEC': Citigroup

Bloomberg News | February 9, 2015 | Last Updated: Feb 9 1:16 PM ET

Citigroup reduced its annual forecast for Brent crude for the second time in 2015. Prices in the $45-$55 range are unsustainable and will trigger "disinvestment from oil" and a fourth-quarter rebound to $75 a barrel, according to the report. Prices this year will likely average $54 a barrel.

The recent surge in oil prices is just a “head-fake,” and oil as cheap as $20 a barrel may soon be on the way, Citigroup said in a report on Monday as it lowered its forecast for crude.

Despite global declines in spending that have driven up oil prices in recent weeks, oil production in the U.S. is still rising, wrote Edward Morse, Citigroup’s global head of commodity research. Brazil and Russia are pumping oil at record levels, and Saudi Arabia, Iraq and Iran have been fighting to maintain their market share by cutting prices to Asia. The market is oversupplied, and storage tanks are topping out.

A pullback in production isn’t likely until the third quarter, Morse said. In the meantime, West Texas Intermediate Crude, which currently trades at around US$52 a barrel, could fall to the $20 range “for a while,” according to the report. The U.S. shale-oil revolution has broken OPEC’s ability to manipulate prices and maximize profits for oil-producing countries.

“It looks exceedingly unlikely for OPEC to return to its old way of doing business,” Morse wrote. “While many analysts have seen in past market crises ’the end of OPEC,’ this time around might well be different,” Morse said.

Citi reduced its annual forecast for Brent crude for the second time in 2015. Prices in the $45-$55 range are unsustainable and will trigger “disinvestment from oil” and a fourth-quarter rebound to $75 a barrel, according to the report. Prices this year will likely average $54 a barrel.

West Texas Intermediate crude slid 46% last year as the Organization of Petroleum Exporting Countries resisted calls to cut supply as it competed for market share against U.S. drillers pumping at the fastest rate in more than three decades. There will be an oversupply of about 2 million barrels a day in the first half of 2015, Iranian Oil Minister Bijan Namdar Zanganeh said in an interview on state TV Feb. 4.

“Not only is the market oversupplied, but the consequent inventory build looks likely to continue toward storage tank tops,” Morse said. “It’s impossible to call a bottom point, which could, as a result of oversupply and the economics of storage, fall well below $40 a barrel for WTI, perhaps as low as the $20 range for a while.”

Rig Count

WTI for March delivery rose 0.3% to US $51.83 a barrel by 9:14 a.m. London time in electronic trading on the New York Mercantile Exchange. The U.S. benchmark gained 7.2% last week, the biggest weekly advance in four years, as U.S. producers pulled rigs off oil fields for a ninth week.

Drillers idled 83 rigs last week, cutting the total number in operation to 1,140, the lowest since December 2011, according to data from Baker Hughes Inc. Friday.

Oil should bottom between the end of the first quarter and beginning of the second quarter in the $40 range, Morse said. At that point, the market should start to balance, first with an end to inventory builds and later on with declining stockpiles.

U.S. crude inventories expanded by 6.33 million barrels to 413.1 million in the week ended Jan. 30, the highest in weekly records compiled since 1982, Energy Information Administration data show. Crude output rose 27,000 barrels a day to 9.21 million a week earlier, the most in weekly estimates that started in 1983.

Oil supply will probably exceed demand by 700,000 barrels a day in the first quarter and 800,000 barrels a day in the second quarter, Morse said in the report. Stockpiles at Cushing, Oklahoma, the delivery point for WTI, have climbed 29% this year to 41.4 million barrels by Jan. 30, according to EIA data. They are “heading toward tank-tops,” according to Morse.

http://business.financialpost.co ... up/?__lsa=e42d-916a

|

|

|

|

|

|

|

|

|

|

|

|

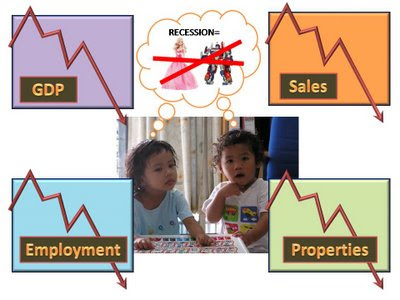

apa berlaku apabila ekonomi mengalami deflasi?

|

|

|

|

|

|

|

|

|

|

|

|

FRIDAY, DECEMBER 18, 2009

Apa Itu DEFLASI ?????

Apabila kita berbicara tentang deflasi, terdapat kekeliruan yang mana ramai diantara kita yang kurang memahami erti 'APA ITU DEFLASI'. Namun, apabila ditanya berkaitan krisis ekonomi dan kemelesetan ekonomi, pasti ramai yang bersedia mengangkat tangan menjelaskan apa itu kemelesetan ekonomi. Deflasi boleh diertikan sebagai masalah kemelesetan ekonomi yang berlaku di sesebuah negara.

Dalam ekonomi, deflasi merupakan penurunan tingkat harga umum barangan dan perkhidmatan yang berterusan di bawah inflasi sifar. Deflasi adalah lawan kepada inflasi. Bagi ahli ekonomi, istilah ini menjadi dan kadang kala digunakan untuk merujuk pada penurunan dalam jumlah bekalan wang (sebagai satu sebab langsung penurunan dari tingkat harga umum). Akan tetapi, kini penurunan jumlah bekalang wang ini lebih sering dirujuk sebagai sebuah "pengecutan" belakan wang. Ketika deflasi, permintaan untuk kecairan akan naik, berbanding barangan atau faedah. Sewaktu deflasi kuasa beli wang juga naik.

Deflasi dianggap sebagai satu masalah dalam ekonomi moden kerana potensi lingkaran deflasi dan kaitannya dengan Zaman Kemelesetan.

Krisis kewangan sistem ekonomi barat yang bertunjangkan sistem riba’, bunga berganda dan penindasan,kini sedang melumpuhkan sektor perbangkan dan ekonomi Amerika Syarikat, Eropah dan beberapa buah negara lain dalam sekelip mata sahaja,Usaha-usaha pemulihannya masih buntu serta belum ada tanda-tanda ekonomi berunsur pulih kembali.

Kemelesetan ekonomi yang berlaku ini juga satu terjemahan terhadap peperangan yang dilancarkan oleh allah terhadap sesiapa yang mendokong sistem ekonomi yang berpaksikan penindasan melalui sistem riba’,sepertimana yang disebutkan oleh allah subhanahu wataala dalam firmannya surah al-baqarah ayat 278-279:

“Wahai orang yang beriman!,hendaklah kamu bertakwa kepada allah dan menjauhi saki-baki riba’ (yang masih ada pada orang yang berhutang) itu,jika benar kamu orang yang beriman.Jika kamu tidak mahu melakukan (perintah mengenai larangan riba’ itu), maka ketahuilah bahawa allah dan rasulnya akan memerangi kamu (akibatnya kamu tidak akan selamat), dan jika kamu bertaubat (mengkhianatinya),maka hak kami (yang sebenarnya) ialah modal pokok harta kamu.(Dengan yang demikian) kamu tidak mengenai (kepada sesiapa), dan kamu juga tidak teraniaya”.

Isu gejala kemelesetan ekonomi yang berpunca daripada krisis kewangan di amerika syarikat yang kemudiannya berjangkit kenegara-negara industri dibarat serta beberapa buah negara sedang membangun dirantau asia kini nampaknya menjadi isu semasa.

Krisis ekonomi itu turut dijangka membawa kepada lebih banyak masalah pengangguran apabila pekerja-pekerja terpaksa dihentikan.

Pakar ekonomi Malaysia,Senator Profesor Doktor Ismail Muhammad Saleh berkata,keadaan ekonomi di amerika syarikat turut membawa tempias kepada negara ini. Menurut beliau:

“Pengangguran dinegara ini akan meningkat kepada lebih empat peratus terutama dalam sektor industri elektronik”.Beliau menjelaskan,keadaan itu berlaku berikutan kebanyakkan produk elektronik malaysia dieksport kenegara-negara barat.

Persekutuan majikan-majikan malaysia (MEF) turut menjangka pemberhentian pekerja dinegara ini akan serius pada tahun 2009 dengan anggaran 200,000 hingga 400,000 orang hilang pekerjaan seperti yang dilaporkan.Justeru ,bagi menghadapi segala kemungkinan yang timbul berpunca daripada gejala kemelesetan ekonomi global dan serantau,kita tidak dapat tidak,harus mengambil langkah dalam membuat persediaan tertentu bagi menghadapinya.

Ada pun yang dimaksudkan dengan persiapan disudut perancangan kewangan ialah mengutamakan kaedah berkhemah ketika berbelanja:

* Membeli barang keperluan secara pukal dengan menyenaraikan nama barang sebelum keluar membeli.

* Elakkan dari membuat hutang baru.

* Elakkan dari membeli barangan mewah seperti perebutan dan lain-lain.

* Tidak terpengaruh dengan promosi jualan murah.

* Membawa bekal ketika pergi ke tempat kerja begitu juga bekalan untuk anak-anak ke sekolah.

* Elakkan dari membazir seperti mengadakan majlis-majlis keraian di hotel-hotel mewah.

Posted by Naz at 2:06 AM

http://teachernaz.blogspot.com/2009/12/apa-itu-deflasi.html

agaknya turun tak harga rumah?

|

|

|

|

|

|

|

|

|

|

|

|

|

bukan dua-tiga hari ni harga minyak mentah dunia naik sikit ke acong? |

|

|

|

|

|

|

|

|

|

|

|

ntah....... aku bukan pakar ekonomi.......

The recent surge in oil prices is just a “head-fake,” and oil as cheap as $20 a barrel may soon be on the way, Citigroup said in a report on Monday as it lowered its forecast for crude.

|

|

|

|

|

|

|

|

|

|

|

|

strategi bagi miskin negara Islam mcm arab..brunei... |

|

|

|

|

|

|

|

|

|

|

|

deflasi = monopos....  |

|

|

|

|

|

|

|

|

|

|

|

Acong replied at 10-2-2015 06:19 PM

ntah....... aku bukan pakar ekonomi.......

Kau jgn nak chong lah Acong.....

Tak de nya nk turun sampai $20.... |

|

|

|

|

|

|

|

|

|

|

|

jgn lah jadi betul .

kesian..nnti rmai hilang kerja..

kerajaan pon akan terasa besar la since petronas kan salah satu lubuk emas kerajaan jgk nak dptkan source of funding. |

|

|

|

|

|

|

|

|

|

|

|

aku berharap sgt deflasi nie........ biar bungkus spekulator hartanah........

|

|

|

|

|

|

|

|

|

|

|

|

Acong replied at 10-2-2015 07:15 PM

aku berharap sgt deflasi nie........ biar bungkus spekulator hartanah........

Aku punn......

Aku nk tunggu smpai hujung thun ni....

Skrg ni pun aku tgok dah mula ada rumah lelong.....dulu susah gak nk jumpa...skrg satu taman ada dua tiga dah....

|

|

|

|

|

|

|

|

|

|

|

|

Atifan replied at 10-2-2015 07:04 PM

jgn lah jadi betul .

kesian..nnti rmai hilang kerja..

kerajaan pon akan terasa besar la since petr ...

Masa tu lg ramai yg layak dpt BRIM....

Kau rasa ada lg tak BR1M tu??..... |

|

|

|

|

|

|

|

|

|

|

|

|

Makin kaya la cina kapitalist yg x nk turunkan harga barang |

|

|

|

|

|

|

|

|

|

|

|

minyak xkan hilang kepentingan dari dunia walaupun harga setong hanya $5 dollar dan kos pengeluaran $20 setong  |

|

|

|

|

|

|

|

|

|

|

|

|

klu minyak xefektif uuntuk dikormersilkan abis jet pejuang kete kebal meriam nak pakai ape???? minyak kelapa sawit? |

|

|

|

|

|

|

|

|

|

|

|

agaknya turun tak harga rumah?

property sure go up hwanggggggg....rumah harga RM90k tahun 2012 bakal jadi RM300k tahun 2020 dan RM600k tahun 2030

|

|

|

|

|

|

|

|

|

|

| |

|