|

|

[Jenayah]

SR, Wall Street Journal berterusan memfitnah Najib- PANAS! bukti dah keluar

[Copy link]

|

|

|

mungkin dia tunggu mamak azeez raheem taboong hajee jual tanah dulu kot... |

|

|

|

|

|

|

|

|

|

|

|

Ya Rabbi bebalnye PM ni.

Rakyat marhaen ni daripada kurus sebab puasa sampai gemok balik sebab raye tak boleh lagi nak bagitahu ko buat ape ngan duit berbilion tu?

|

|

|

|

|

|

|

|

|

|

|

|

Singapore's police have frozen two bank accounts as part of an investigation linked to Malaysian sovereign fund 1MDB, which is being probed by authorities in Malaysia for financial mismanagement and graft.

"On 15 July 2015, we issued orders under the Criminal Procedure Code to prohibit any dealings in respect of money in two bank accounts that are relevant to the investigation," Singapore police said in a statement today.

It did not identify the bank or the accounts in question because the investigation is continuing.

The Wall Street Journal (WSJ) reported that investigators looking into 1MDB had traced close to US$700 million (RM2.6 billion) of deposits into personal bank accounts belonging to Prime Minister Najib Razak.

Reuters has not verified the WSJ report.

Najib has denied taking any money for personal gain and said the corruption allegations are part of a malicious campaign to force him out of office. 1MDB has denied transferring funds to Najib.

- Reuters

Sumber berita |

|

|

|

|

|

|

|

|

|

|

|

Adakah ini percubaan untuk menguatkan sembang kencang bahawa hanya dokumen palsu yang bertebaran di sana sini?

Hackers are reported to have tried to steal sensitive data from 1MDB subsidiary Edra Global Energy Bhd earlier this month.

According to a report by The Edge Financial Daily, no information was stolen during the hacking attempt.

The daily also reported that Edra Global had filed a police report on the matter at the Dang Wangi district police headquarters on July 9.

A copy of the police report sighted by The Edge said the hacking attempt began on July 1, with the hackers trying to log into Edra's servers using identities such as "admin", "support" and "root".

The source of the hacking attack is not known, but is believed to be based abroad.

A Dang Wangi district police spokesperson told Malaysiakini that the case is being handled by Bukit Aman.

Sumber berita |

|

|

|

|

|

|

|

|

|

|

|

Sarawak Report will be filing police reports against Urban Wellbeing, Housing and Local Government Minister Abdul Rahman Dahlan and former journalist Lester Melanyi for criminal defamation.

The whistleblower site will also be suing Rahman, the New Straits Times and others whom it deems to have defamed Sarawak Report.

"We are consulting our lawyers with a view to reporting Rahman to the Malaysian police and also issuing libel proceedings against him and other parties, including the New Straits Times and other publications, which have deliberately promoted falsehoods designed to damage the credibility of Sarawak Report.

"We will also report Lester's vicious criminal libel to the local police (he’s not worth suing) and we warn him and anyone who continues to promote his present and future made-up stories that we will seek appropriate damages," Sarawak Report wrote on its site.

The legal action follows Rahman's endorsement of Lester, who has confessed to being privy to a plot by Sarawak Report to fabricate evidence against 1MDB.

Sumber berita |

|

|

|

|

|

|

|

|

|

|

|

"1MDB tidak pernah membiayai pilihan raya kami. Kami mempunyai sumber dana untuk parti," kata MP Pasir Salak tanpa mendedahkan dengan lebih lanjut.

sumber dana parti kapla hangguk dia

|

|

|

|

|

|

|

|

|

|

|

|

lester melanyi ni yg penah tepek kartun hina Rasulullah..orang camni UMNO caya sangatttt

|

|

|

|

|

|

|

|

|

|

|

|

kat m'sia ni tarap pekerja KTM laaa...yg kelakonya menteri umno rahman dahalan percaya 1000% kat lester ni...asik kena tipu je la umno ni...seblom ni najib kena tipu dgn petrosaudi + jo low..skg ni penjilat lak kena tipu dgn org sarawak yg dah bankrap |

|

|

|

|

|

|

|

|

|

|

|

http://www.bloomberg.com/news/ar ... ned-1mdb-melts-down

The Scandal That Ate Malaysia

In the spring of 2013, Song Dal Sun, head of securities investment at Seoul-based Hanwha Life Insurance, sat down to a presentation by a Goldman Sachs banker. The young Goldman salesman, who had flown in from Hong Kong, made a pitch for bonds to be issued by 1Malaysia Development Bhd., a state-owned company closely tied to Malaysian Prime Minister Najib Razak. It was enticing. The 10-year, dollar-denominated bonds offered an interest rate of 4.4 percent, about 100 basis points higher than other A-minus-rated bonds were yielding at the time, he recalls. But Song, a veteran of 25 years in finance, sensed something was amiss. With such an attractive yield, 1MDB could easily sell the notes directly to institutional investors through a global offering. Instead, Goldman Sachs was privately selling 1MDB notes worth $3 billion backed by the Malaysian government. “Does it mean ‘explicit guarantee’?” he recalls asking the Goldman salesman, whom he declined to name. “I didn’t get a straight answer,” Song says. “I decided not to buy them.” The bond sale that Song passed up is part of a scandal that has all but sunk 1MDB, rattled investors, and set back Malaysia’s quest to become a developed nation. Najib, who also serves as Malaysia’s finance minister, sits on 1MDB’s advisory board as chairman. The scandal’s aftershocks have rocked his office, his government, and the political party he leads, United Malays National Organisation, or UMNO. A state investment company trumpeted as a cornerstone of Najib’s economic policy after he became prime minister in April 2009, 1MDB is now mired in debts of at least $11 billion. Former Prime Minister Mahathir Mohamad, a one-time political mentor who’s turned on Najib, says “vast amounts of money” have “disappeared” from 1MDB funds. 1MDB has denied the claim and said all of its debts are accounted for. The prime minister’s office declined to comment for this article.

From the moment in 2009 when Najib took over a sovereign wealth fund set up by the Malaysian state of oil-rich Terengganu and turned it into a development fund owned by the federal government, 1MDB has been controversial. Since the beginning of this year—with coverage driven by the Sarawak Report, a blog, and The Edge, a local business weekly—the scandal has moved closer and closer to the heart of government, sparking calls for Najib’s ouster and recalling Malaysia’s long struggle with corruption and economic disappointment. Mahathir, who was prime minister from 1981 to 2003, now accuses Najib of “hijacking” the Terengganu Investment Authority, or the TIA, from the state government. Not so, 1MDB said in a statement: The state government willingly “decided to withdraw from the TIA” after the federal government guaranteed the TIA’s bonds.

|

|

|

|

|

|

|

|

|

|

|

|

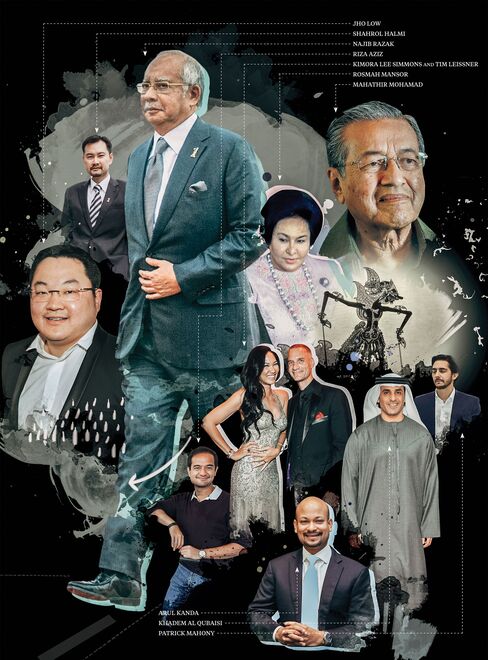

[size=0.6875]Low: Kevin Mazur/Wireimage; Halmi: Goh Seng Chong/Bloomberg; Razak: Wang Ye/Xinhua/Redux; Aziz: J. Emilio Flores/The New York Times/Redux; Leissner: Araya Diaz/Getty Images for the Weinstein; Mansor: Bagus Indahono/Epa/Corbis; Mohamad: Goh Seng Chong/Bloomberg; Kanda: 1MDB; Qubaisi: Gareth Cattermole/Getty Images for Laureus; Mahony: Alo Ceballos/GC Images/Getty

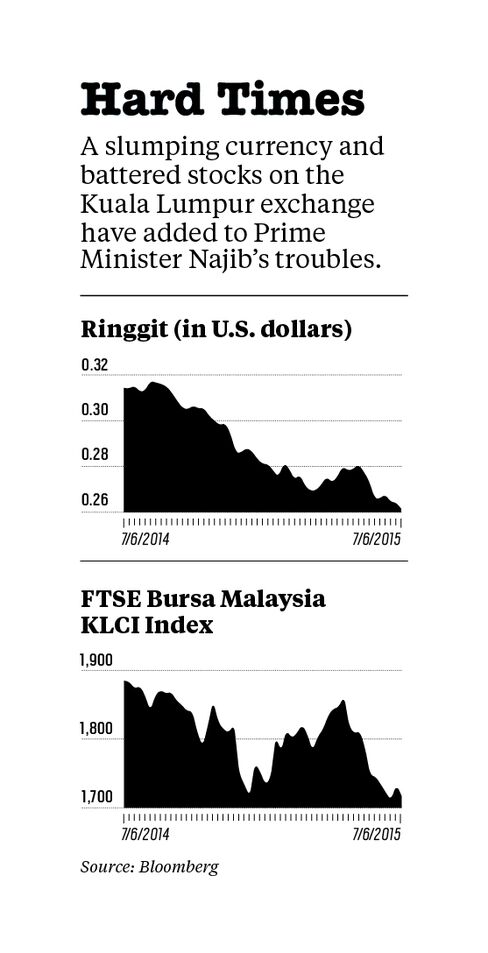

That didn’t end the argument. Beginning in March, as public pressure grew, the country’s auditor general, the parliament’s public accounts committee, the central bank, and the police have all homed in on 1MDB. The force of the scandal helped topple the ringgit, the worst-performing currency in Asia as of July 16, down 8.1 percent against the dollar since the start of the year. Foreign reserves plunged 20 percent in June from a year earlier. On July 3, the Wall Street Journal, citing documents from government probes, reported that investigators believe almost $700 million in cash moved through state agencies, banks, and companies linked to 1MDB before eventually finding its way into Najib’s personal accounts. The money reportedly included two transactions—one worth $620 million; another, $61 million—made in March 2013, two months before a general election returned Najib to power as part of the Barisan Nasional, or National Front, coalition. In a country with no public campaign financing and few strictures on political donations, the alleged cash flows caused alarm. Before the 2013 election, on March 12, 1MDB Chairman Lodin Wok Kamaruddin and Khadem Al Qubaisi, then chairman of Abu Dhabi’s Aabar Investments, signed an agreement to form a joint venture. The following month, 1MDB announced it had raised $3 billion for its share of the partnership. “1MDB opted for a private placement to ensure the timely completion of this economic initiative,” the company said in a statement on April 15 of that year. The timing was controversial. “1MDB may have been created with one of the key objectives being to raise a slush fund to finance Barisan Nasional’s election campaigns,” says MP Tony Pua, of the opposition Democratic Action Party. A statement from the prime minister’s office dismissed the allegations in the Wall Street Journal, saying they amounted to “political sabotage” at the hands of “certain individuals to undermine confidence in our economy, tarnish the government, and remove a democratically elected prime minister.” In a statement, 1MDB said it “has never provided any funds to the prime minister.”

Malaysia’s biggest-ever financial scandal has spotlighted a colorful cast of characters—some connected to 1MDB, some not. A politician since the age of 23, the mustachioed Najib is the eldest son of the country’s second prime minister following its independence from Britain in 1957, Abdul Razak Hussein, and a nephew of the third, Hussein Onn. Najib’s wife, Rosmah Mansor, is an influential figure in her own right. A former executive at Island & Peninsular, a real estate company, she’s often lampooned in the local media for her bouffant hairstyle and penchant for luxury.

Najib’s stepson, Riza Aziz, far left, joins Leonardo DiCaprio and others at the London premiere of The Wolf of Wall Street on Jan. 9, 2014.

[size=0.6875]Photograph: Paul Hackett/Reuters/Landov

Riza Aziz, Rosmah’s son from her first marriage, is close to a Kuala Lumpur man about town who’s been linked to 1MDB named Low Taek Jho. Jho Low, as he’s known, is a whiz-kid dealmaker who exploded onto the gossip pages in 2009. One photo shows the moon-faced Low partying with California socialite Paris Hilton and clutching a bottle of Cristal champagne. The prime minister’s stepson co-founded a Los Angeles company that produced The Wolf of Wall Street, the 2013 film about lifestyle excesses and criminal exploits in the world of finance; Low got a full-screen “special thanks” credit at the end of Wolf. Low helped set up 1MDB’s first joint venture, with PetroSaudi International, according to reports in The Edge and the Sarawak Report. An additional touch of glamour comes from Goldman Sachs executive Tim Leissner, a lanky, blue-eyed German who’s married to former U.S. fashion model and designer Kimora Lee Simmons, the ex-wife of Russell Simmons, co-founder of New York hip-hop music label Def Jam Recordings. In September 2013, when Najib and Rosmah traveled to San Francisco to open a new office of Khazanah Nasional, Malaysia’s sovereign wealth fund, Rosmah and Simmons were photographed together. Leissner, now Goldman’s Southeast Asia chairman, was a fixture in Malaysian dealmaking in the late 2000s. Goldman helped manage billionaire T. Ananda Krishnan’s 2009 initial public offering of Maxis, Malaysia’s biggest mobile phone service provider. Goldman established a close and profitable relationship with 1MDB. From 2012 to 2013, the bank arranged three bond sales for the company, totaling $6.5 billion. Fees, commissions, and expenses for Goldman totaled $593 million—about 9.1 percent of the money raised—according to a person familiar with the sales. “These transactions were individually tailored financing solutions, the fee and commissions for which reflected the underwriting risks assumed by Goldman Sachs on each series of bonds, as well as other prevailing conditions at the time, including spreads of credit benchmarks, hedging costs, and general market conditions,” says Hong Kong–based Goldman spokesman Edward Naylor.

|

|

|

|

|

|

|

|

|

|

|

|

|

In 2013, Goldman arranged 1MDB’s $3 billion bond sale, the one passed up by Hanwha Life’s Song. The note is included in JPMorgan’s benchmark Asian and Emerging-Market Bond indexes. Goldman’s commissions, fees, and expenses from the sale were $283 million, or 9.4 percent of the amount raised, according to the prospectus. The person familiar with the transaction says Goldman’s take was high because the bank bought bonds from 1MDB, assuming the risk, and then resold them to customers. In many ways, 1MDB’s star-crossed existence mirrors the misfortunes of this country of 30 million people. Najib set up 1MDB at a time when the Malaysian economy was on the mend; it expanded by 7.4 percent in 2010, becoming one of the fastest growing in Southeast Asia. The company—supported by the advisory board chaired by Najib and including high-ranking government officials from China, Saudi Arabia, and the United Arab Emirates—set out to be a state-owned strategic development company that would forge global partnerships, draw foreign investment to Malaysia, and build up the country’s industrial base. Early on, 1MDB formed joint ventures with Saudi and Abu Dhabi companies. On a visit to Malaysia in July 2013, Japanese Prime Minister Shinzo Abe attended a signing ceremony that was meant to initiate discussions on 1MDB’s plan to issue Samurai bonds guaranteed by the Japan Bank for International Cooperation. None of these plans panned out as they were supposed to. Over time, to its growing number of detractors, 1MDB looked more and more like a giant black box, its inner workings echoing the mysteries suggested by the wayang kulit, traditional shadow puppets, that frolic on the office walls of the Kuala Lumpur–based company.

[size=0.6875]Left to right: Nigny/Splash News/Corbis; Eugene Hoshiko/AP

1MDB, which has announced plans to wind itself down, is reducing its debt, according to President Arul Kanda. “1MDB has undertaken various initiatives to reduce the company’s debt levels and ensure that maximum value is generated for its 100 percent shareholder, the Ministry of Finance,” Kanda said in a statement to Bloomberg Markets on July 16. As part of the plan, 1MDB has repaid a $975 million loan, while more than 40 potential investors have shown interest in one of its property developments, Bandar Malaysia. He said the company also intends to sell its power plants. “We are focused and are making good progress,” he said.

The 1MDB story begins in 2008. In December of that year, Terengganu, a sultanate located across the Malay Peninsula from Kuala Lumpur, got federal government approval to set up its sovereign wealth fund, the TIA. Goldman Sachs and Boston Consulting Group advised the TIA in its early days. Jho Low advised the TIA from January to mid-May, according to a statement released on his behalf to local media in May 2014. In May 2009, the TIA raised 5 billion ringgit ($1.3 billion) through the sale of 30-year Islamic bonds. Guaranteed by the federal government, they were offered at an interest rate of 5.75 percent. In fact, according to Mahathir, the bonds were sold at a discounted price that effectively yielded bondholders 7 percent. “Who approved such terrible terms for a loan to a government-owned company?” the former prime minister asked on his blog. 1MDB said in response that the effective yield was actually 6.15 percent and was reasonable considering that these were Malaysia’s first 30-year notes. Two months later, the Najib government quietly took over the TIA and renamed it 1MDB. As the new company was getting up and running, the well-connected Low laid the groundwork for 1MDB’s dealings with the Saudis, according to reports in The Edgeand the Sarawak Report. The son of a wealthy Malaysian businessman, Larry Low, Jho studied at Harrow, an elite London boarding school. While there, he met Najib’s stepson, Riza Aziz, who was studying at the London School of Economics and Political Science, and came to know Riza’s mother, Rosmah, when she visited London, according to a New York Times report in February. Later, at the Wharton School at the University of Pennsylvania, he took a semester off to start a company called Wynton Group, managing $25 million pooled mostly from his friends’ families, according to an interview he gave to Malaysia’s Star newspaper in 2010.

|

|

|

|

|

|

|

|

|

|

|

|

panjang nye artikel bloomberg yahudi ni  |

|

|

|

|

|

|

|

|

|

|

|

Police raid 1MDB’s offices in Kuala Lumpur on July 8, seizing computers and other equipment.

[size=0.6875]Photograph: Mohd Rasfan/AFP/Getty Images

In a similar vein, Low’s role at 1MDB involved “OPM”—other people’s money, says a former business associate in Kuala Lumpur. By now, Low had assembled an impressive array of connections. On Sept. 7, 2009, Low met Patrick Mahony, an executive of PetroSaudi International, in New York, according to a report in The Edge. Tarek Obaid, a co-founder of PetroSaudi, had introduced them to each other via e-mail on Aug. 28, the report said. It didn’t take long for 1MDB and PetroSaudi to cobble together a $2.5 billion joint venture. Mahony didn’t respond to e-mailed questions. Obaid couldn’t be reached for comment. As it got off the ground, 1MDB worked with more than a dozen financial institutions, but it forged especially close ties with Goldman. A helping hand came from Roger Ng, Goldman’s head of Southeast Asia sales and fixed-income trading, a Malaysian national well-known for his connections to politicians and tycoons, according to two people who know him. Leissner, then based in Singapore as Goldman’s co-president for Southeast Asia, played a key role in expanding the bank’s business in Malaysia. He declined to comment for this article. Ng, who left Goldman last year, didn’t respond to phone calls or a text message. In December 2009, Goldman won a license from Malaysia’s Securities Commission to set up fund management and corporate finance advisory operations in the country. “The future outlook for Malaysia’s capital markets and its asset management industry is very positive,” Leissner said in a statement released by the commission at the time. “Through our local presence, we look forward to playing a larger role in their development.” For 1MDB, Goldman played multiple roles. In 2012, it advised the firm on its acquisition of Tanjong Energy Holdings from Malaysian billionaire Krishnan and domestic power plants from Genting, a conglomerate. The following year, the bank helped 1MDB purchase the Jimah Energy Ventures power plant in Selangor, Malaysia, a deal that was completed in 2014. The true extent of the trouble at 1MDB didn’t become apparent until late last year. Scandal aside, 2014 was a difficult year for Najib and his government. First came the disappearance of Malaysia Airlines Flight 370 and all 239 people on board in March. Then, in July, Flight 17, also operated by the state-owned airline, crashed near Donetsk in strife-torn eastern Ukraine, possibly after being hit by a surface-to-air missile; all 298 passengers and crew died. It was around that time that the Sarawak Report and The Edge, under longtime editor Ho Kay Tat, began their exposés of 1MDB, adding to Najib’s woes. The Sarawak Report was founded by Clare Rewcastle Brown, who was born in Sarawak, a state on the island of Borneo, of British parents and now runs the site out of London. (Her husband, Andrew Brown, who recently retired as the head of media relations at EDF Energy, is the brother of former U.K. Prime Minister Gordon Brown.) Earlier this year, the website claimed to have obtained e-mails and other documentation showing how Jho Low and several business associates siphoned $700 million from 1MDB’s venture with PetroSaudi Holdings, which was registered in the Cayman Islands in the Caribbean. Low, who has denied playing any role in 1MDB after the work he did for the TIA, didn’t respond to requests for an interview or to e-mailed questions. The government, without giving any details, has tried to discredit the e-mails as reported by the Sarawak Report, saying the communications may have been tampered with. Then on July 19, the Malaysian Communications and Multimedia Commission said it had blocked the Sarawak Report’s website in Malaysia for publishing content that could "destabilize the country." Rewcastle Brown said she won’t be impeded by the government’s action, describing it as the “latest blow to media freedom.” In an unprecedented crackdown, Malaysian authorities this year have arrested more than 150 journalists, activists, opposition politicians, and lawyers on sedition charges or under a peaceful assembly act that strictly regulates public protests. One of Malaysia’s best-known political cartoonists, who goes by the name Zunar, has been charged with nine counts of sedition and faces up to 43 years in prison. On June 22, Thai police arrested a tattooed Swiss national named Xavier Justo, a former executive at 1MDB investment partner PetroSaudi International, on the resort island of Koh Samui. Police said they suspected Justo of trying to extort money from PetroSaudi and leaking e-mails about the oil company’s dealings with 1MDB. Justo denied the allegations, the Bangkok Post reported.

Adding to a climate of fear and tension, the Malaysian police launched an investigation into whether government officials, including central bank personnel, were behind the leaking of documents that allegedly showed 1MDB money turning up in Najib’s accounts. The central bank on July 12 denied any impropriety.

As allegations swirl around him, the stakes for Najib are high. Not only is he prime minister and finance minister; he’s also president of a political machine, UMNO, that has been in power since Malaysia’s independence. What’s more, he’s chairman of the Khazanah Nasional sovereign wealth fund, which had $29 billion under management at the end of 2014. “Power is too concentrated to one person,” says Zaid Ibrahim, a former law minister who built the country’s largest law firm. He says the total lack of checks and balances in Malaysia has led to abuse of power. In the early days of Najib’s rule, Malaysians had more cause for optimism than now, says Danny Quah, an economics professor at the LSE. Like many successful Malaysians overseas, Quah has maintained ties with his native country. He served on Malaysia’s National Economic Advisory Council from 2009 to 2011, and he still vividly recalls a day—March 30, 2010—when Najib stood in front of global investors and promised a “1Malaysia” where all Malaysians of different races would work together toward one goal—turning Malaysia into a developed nation by 2020. At the time, Najib had enough popular support to aim high. “Right then, it was a golden opportunity,” Quah says. “It’s a moment that passed.” Mahathir, 90, shows no signs of letting his erstwhile protégé off the hook. After a poor showing by UMNO in the March 2008 elections, Prime Minister Abdullah Ahmad Badawi stepped down the following year and was replaced by his deputy prime minister, Najib. Over time, Mahathir said later, he became disillusioned with Najib’s management of the economy. He said he expressed his doubts first privately and then publicly. With the 1MDB scandal gaining momentum, outright war broke out between Mahathir and Najib. Najib, Mahathir said in June, had crossed the line. “1MDB is the straw that broke the camel’s back,” said Mahathir, who has repeatedly called for Najib to resign. Najib, who says he won’t step down, lashed back at Mahathir, known by the honorific Tun. “The ‘mess’ that Tun refers to is largely of his own making as a result of his attacks and his echoing of opposition lies and slander,” Najib wrote on his website. As words flew between Mahathir and Najib in June, the Malaysian Volunteer Lawyers Association organized a forum to hear from Najib on 1MDB. It was called Nothing2Hide. Mahathir saw a chance to speak his mind about 1MDB and the money he said was missing. “I feel obligated to explain to the people what really happened and why I’ve decided not to support Najib any longer,” he said to the gathering. “This is not about me or Najib. It’s about the whole nation because what was lost belonged to all of us. I am just a spokesperson. Many people have come to me, asking me to do something.” About 10 minutes into Mahathir’s speech, uniformed police moved in and stopped the aging but still spry former prime minister from speaking. Whatever Najib thought of the action taken against his mentor-turned-rival may never be known. Amid police concerns about “public order and national harmony,” he didn’t show up. This story appears in the September issue of Bloomberg Markets magazine. With assistance from Ye Xie in New York.

|

|

|

|

|

|

|

|

|

|

|

|

Komen aku.

Harap penyamun dan kuncu rot in hell.

|

|

|

|

|

|

|

|

|

|

|

|

best fren dgn kompeni yahudi Goldman sachs...ratus juta bg kat dorang...bila kat org kampung cakap org yahudi berkonspirasi nak jatuhkan kerajaan

|

|

|

|

|

|

|

|

|

|

|

|

Depan melayu kampung jerit la DAPig agen yahudi, anwar agent israel, tapi kat belakang dia la yg duk support Yahudi, Amerika pun tak bayar fees tinggi kat Yahudi Goldman tu mcm 1MDB.

|

|

|

|

|

|

|

|

|

|

| |

|